A Federal Court in Maryland granted Ms. Krysztofiak’s motion to reopen her claim after the court found that she exhausted all administrative remedies. The Court held that Boston Mutual’s attempts to toll her ERISA deadline were ineffective and untimely.

Ms. Krysztofiak, the claimant, appealed the denial of her benefits in a timely fashion. Boston Mutual Life Insurance Company (“Boston Mutual”) then sent Ms. Krysztofiak a medical release form requesting her signature. Ms. Krysztofiak returned the form promptly.

One week later, Boston Mutual called Ms. Krysztofiak’s counsel asking if she was going to submit any additional information. Counsel replied that it would have to get back to the insurance administrator. Counsel seemingly did not get back to Boston Mutual.

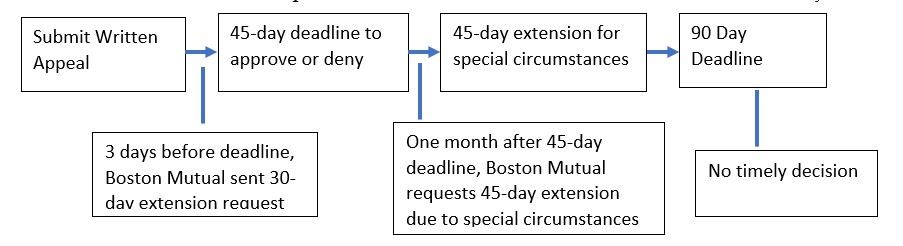

Just three days before Ms. Krysztofiak’s appeal decision was due, Boston Mutual sent her a letter providing “an unsolicited 30-day extension” to submit additional information.

Almost five weeks after Ms. Krysztofiak’s appeal deadline had passed, Boston Mutual’s claim administrator told Ms. Krysztofiak that it wanted to conduct an independent medical examination (“IME”), and that it was extending its deadline to decide the appeal by 45 days, citing “special circumstances.” Ms. Krysztofiak did not attend the IME, and instead, she filed her motion to reopen her claim.

Under ERISA, once a claimant files a timely appeal, the insurance company must decide the claim within 45 days. However, this 45-day deadline may be tolled when the insurance company’s claim administrator is waiting to receive information from the claimant. The 45-day deadline may also be tolled one time for an additional 45-days for “special circumstances.”

Here, the court rejected Boston Mutual’s argument that Ms. Krysztofiak’s motion was premature because Boston Mutual had “effectively tolled and extended” the appeal deadline. The court held that Boston Mutual’s first letter to Ms. Krysztofiak did not extend the deadline because it was missing the necessary tolling language. It “did not invoke the 45-day extension,” did not make clear that additional information was necessary to decide her claim, nor did it indicate “that the tolling would last until Ms. Krysztofiak had submitted the requested information.”

The court then rejected that Boston Mutual’s second argument, that it effectively invoked the 45-day extension for “special circumstances.” Because Boston Mutual invoked the 45-day extension over a month after the initial appeal deadline, Boston Mutual’s attempt was untimely and “far too late to extend the [appeal decision] period.” The court further stated that even if the first 30-day toll had been effective, the 45-day special circumstances toll was still one week past that already extended appeal deadline.

Therefore, the court held that Ms. Krysztofiak exhausted her administrative remedies, and her motion to reopen her claim file was granted.

Attorneys That Specialize in Handling Your Disability Insurance Claims

This law firm was created with a single purpose in mind: to help people get disability benefits from insurance companies.

With that kind of focus, we have:

- Experience with every major disability insurance company.

- A proven track record of success in major disability lawsuits.

- Recovered millions of dollars in disability benefits for our clients.

Further, we never charge fees or costs unless our clients get paid.

Every day, our disability lawyers work to get insurance companies to approve long-term disability claims or appeal disability benefits denials.

With so much at stake, shouldn’t you have expert disability lawyers on your side?

Because federal law applies to most disability insurance claims, we do not have to be located in your state to help.

Call us at (800) 969-0488 or contact us online to speak with an experienced disability attorney. Consultations are free.