Yes, you can request a lump sum payment while receiving LTD benefits. There are several things to consider when thinking about a lump sum payment.

Once a disability claim is approved, you typically receive monthly income payments so long as you continue to prove your disability. Disability insurance policies typically pay through age 65 or normal social security retirement age.

At some point, depending on the severity of your disabling condition, the insurance company may offer you a lump sum settlement instead of paying you monthly. You can also request a lump sum settlement from your disability insurance company even if they do not offer you one first.

Understanding a Lump Sum Settlement Offer

A lump sum settlement is an offer of a one-time payment now by your disability insurance company instead of continuing to send you monthly benefits. Typically, these lump-sum settlements only offer a portion, and not the full value, of your future long-term disability benefits.

It is important to understand that accepting a lump sum settlement offer forgoes all future payments.

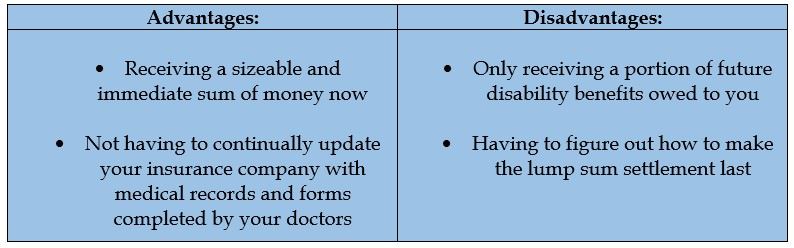

There are advantages and disadvantages of a lump sum settlement offer including:

Would an Insurance Company Make a Lump Sum Settlement Offer Upon Request?

That depends on the nature of your disability. When a disability insurance company makes a lump sum settlement offer, it is probable that it makes financial sense – for them – to do so. A lump sum settlement generally saves the insurance company money in the long run if liability is certain through the entirety of the insurance policy’s term. But not all people who are receiving monthly disability benefits get offered a lump sum settlement offer. This is because the insurance carriers consider a number of factors including:

- The nature of your disability;

- Your age; and

- The duration of the policy.

Things to Consider in a Lump Sum Settlement

You can request a lump sum settlement offer from your disability insurance company while you are receiving benefits. Moreover, discussions regarding a lump sum settlement offer should not affect your monthly payments until an offer is accepted. You should consider several factors when a lump sum settlement offer is presented to you including:

- The value of your long-term disability claim, taking into account its present value;

- Whether your policy includes changes in the benefit amount, such as a cost-of-living adjustment;

- What your life expectancy, as monthly benefits stop once you are gone;

- Whether your lump sum settlement will be taxable;

- If you are able to manage the money and make it last.

Our Lawyers Specialize in Disability Insurance Claims

Because our law firm has always focused only on disability insurance, our lawyers are experts in legal representation for disability insurance benefits.

That means our disability lawyers have:

- Won several major disability lawsuits that help make better law for disability claimants;

- Experience fighting every major insurance company, such as UNUM, Hartford, MetLife, CIGNA, Prudential, and more.

- Successfully represented hundreds of clients and won millions of dollars in disability benefits.

Because federal law applies to most disability insurance claims, we can help clients across the country.

Disability insurance companies have lawyers. You should too. Call Dabdoub Law Firm to get experienced disability lawyers on your side.

We can help with:

- Submitting your disability insurance claim,

- Appealing a long-term disability denial,

- Negotiating your lump-sum settlement, or

- Filing a lawsuit against your disability insurance company.

Call us at (800) 969-0488 or contact us online to speak with an experienced disability attorney. Consultations are free.

.jpg)