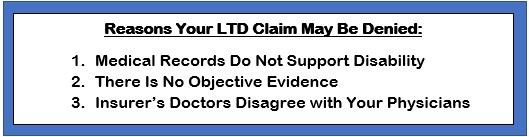

Becoming disabled from working can be daunting. Filing a disability insurance claim can be confusing, stressful, and frustrating. If you are filing for disability through your employer’s insurance company, it is important to understand the reasons why you may have your claim denied.

If your long-term disability claim is denied, that does not necessarily mean that you are not entitled to these benefits. A denial by the insurance company for any of the below reasons also does not necessarily mean that you do not have a valid disability claim.

- Medical Records Do Not Support Disability

If the insurance company claims that your medical records do not support a finding of disability, this may be because they have misinterpreted the policy language or even your medical records.

It could also mean, however, that your doctors’ medical notes do not detail in writing your ailments or your restrictions and limitations. Physicians are trained to diagnose and treat conditions—not to document physical or mental limitations their patients experience.

Make sure your doctor is recording your symptoms and detailing them in every office visit note.

- There is No Objective Medical Evidence

Lack of objective medical evidence is typically testing such as X-Rays, MRIs, CT scans, EKGs, cognitive testing, and laboratory findings, among other verifiable medical sources.

While most disability insurance policies do not require “objective medical evidence” to establish a disability, this is a common reason used to deny a claim. Many times, there is objective medical evidence in the file, but the insurance company does not view it as objective. Other times they simply ignore its validity.

Conditions such as migraines, ME/CFS, fibromyalgia, and other similar conditions are often denied for this reason.

- Insurer’s Nurses or Doctors Disagree with Your Physicians

Disability insurance companies typically have in-house nurses or doctors review the medical records when a claim is submitted. Sometimes the insurance company may hire an outside consulting physician specializing in the type of claimed disabling condition to write a report and issue an opinion.

After conducting a review, if the insurance company’s medical reivers opines that you should still be able to work, your claim will be denied. This can happen even if that opinion is different from what your treating physicians have said.

Insurance Companies Have Lawyers. Shouldn’t You?

Our experience in disability insurance claims means that our clients have the backing of a law firm that has attorneys who have:

- Fought all major disability insurance companies and know their tactics; and

- A track record of success against disability insurance companies.

All our lawyers commit every day of their legal career to helping people get disability benefits from UNUM, MetLife, Prudential, Northwestern Mutual, Hartford, CIGNA, and others.

Because federal law applies to most employer-provided disability insurance claims, we do not have to be located in your state to help. We help clients nationwide.

Call to get an experienced long term disability insurance lawyer on your side.

.jpg)