You have a disability and cannot work. You have disability insurance with New York Life. So, you may think it is a guarantee that you will get paid disability benefits. However, that is not the case.

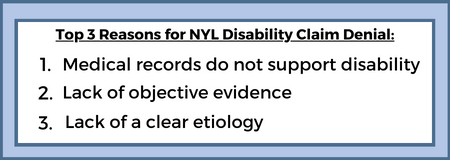

You still have to prove to the insurance company that you are disabled and unable to work. Even with significant evidence, New York Life may still find a reason to deny your claim. Below are three common reasons we see for denials of LTD claims.

Medical Records Do Not Support Disability

If this sounds vague and generic, that is because it is. New York Life can use this reasoning to deny a number of claims, all with different disability and conditions.

As part of every single claim and subsequent appeal, the insurance company is required to conduct a medical review of the claim with the appropriate medical professional for the disability.

Often, the reviewing nurse or doctor will disagree that you are disabled and say that the medical records provided do not support disability. Another way that it can be phrased is the medical records do not support functional limitations or are of such severity to preclude full-time work.

Lack of Objective Evidence

Another reasoning for denial of disability claims is the lack of objective evidence. Objective evidence typically refers to imaging such as an MRI or CT scan, laboratory work, or a diagnostic test used to diagnose a condition.

Whether such a denial is acceptable depends on your disability policy. Some policies have explicit requirements for objective measures, some only for certain conditions, and some do not mention it at all. If the policy does not state that objective measures are required, then the insurance company cannot require it.

Lack of a Clear Etiology

Similar to the reasoning above, New York Life will sometimes deny claims because there is a lack of clear etiology. Said another way, the cause of your symptoms is unknown. However, similar to above, the disability policy has to require a diagnosis or etiology. If it does not mention it, then the insurance company cannot impose that requirement.

The attorneys in our firm are well versed in NYL claim denials. We know how NYL handles a denial and what is needed to push back against it. If NYL has denied your claims, contact one of our experienced disability insurance attorneys today.

Disability Insurance Companies Have Lawyers. Shouldn’t You?

If you are facing a long term disability claim denial, you should consult an experienced disability lawyer. Our lawyers specialize in disability claims with insurance companies.

Why Us?

- This law firm has expertise in disability insurance claims;

- The firm was built to fight for people who were wrongly denied long term disability benefits;

- We have fought every major disability insurance company and recovered millions of dollars in disability benefits for clients;

- We have a proven track record of success and have major disability lawsuits that helped make new law.

Because federal law applies to most disability insurance claims, we do not have to be located in your state to help.

All our lawyers commit every day to helping people get disability benefits from insurance companies. Call to get help with:

- Submitting a disability insurance claim,

- Appealing a long-term disability denial,

- Negotiating a lump-sum settlement, or

- Filing a lawsuit against your disability insurance company.

Contact us online for a free consultation with a disability attorney.